- Best personal budgeting software 2018 for mac#

- Best personal budgeting software 2018 upgrade#

- Best personal budgeting software 2018 pro#

If you apply for a product, your application will be assessed by the provider issuing the product. Finty is not a credit provider, nor does it advise consumers to apply for a specific product with any provider in particular.

Finty does not list every product currently available in the market.

Finty earns a commission for applications referred from this website. Finty is a free-to-use comparison website where Australians can compare financial products. The credit provider’s final decision is made at their discretion, subject to decisioning criteria.ĭISCLAIMER: Finty Australia is owned and operated by Boyd Creative Pty Ltd. However, approval of your application is not guaranteed. Calculations in comparison tables will vary based on personal data input.Ģ Products with instant approval have a provisional decision within 60 seconds. Office 2 Suite 92, Level 1, 515 Kent Street, Sydney, NSW 2000, Australia.ġ The use of "featured", "popular", "best" and "top" on Finty Australia do not constitute a product rating or recommendation and are subject to our general disclaimer.

Best personal budgeting software 2018 upgrade#

Cost: Basic plan is free, Moneytree Grow upgrade is $4.49 per month with a 12% discount for annual subscribersįinty Australia.This paid feature offers daily background updates, exports of all data across your accounts to an Excel or CVS file, and a monthly report to get a more detailed overview of your spending. There’s also a work expenses tracker, which can be converted into a spreadsheet, and fancy graphs to give you a visual story of your finances.Īt the end of August 2019, Moneytree announced its premium product, Moneytree Grow. As with many other personal finance apps, you can use Moneytree to track spending, set budgets, and analyse your spending in an attempt to keep it under control. your frequent flyer or store card accounts. However, the sweet bonus with Moneytree is that you can link to your loyalty cards, too, i.e. Launched in Australia in 2017, Moneytree works a lot like Pocketbook and MoneyBrilliant in that it links all your accounts, cards and super in one place. Cost: $2.50 per month management fee for balances under $10,000 or 0.275% per year for balances over $10,000.For more detail read our complete review of the Raiz Invest app. There are no withdrawal fees if you decide to take money out. A monthly management fee of $2.50 is charged on balances under $10,000. For example, if you buy a coffee for $3.60, Raiz will round it up to $4.00 but invest the 0.40 cents on your behalf. The Raiz app works by rounding-up your expenses to the nearest dollar and investing the difference. The end result should be a higher return for lower risk. Raiz spreads your investment across hundreds of the most widely held Australian and international companies, corporate bonds, government bonds and cash. Diversifying is a financial management strategy that mixes different assets within a single portfolio. Raiz (formerly known as Acorns) is a micro-investing app that automatically deposits your spare change into one of six diversified portfolios. Seems to me that this one can be both great or bad, depending upon your needs.If you’ve already got your budgeting and tracking apps lined up, the next thing you could look at is investing some of your hard-earned cash. As expected, it has some great feature s and makes your life much easier, but on the other hand, I can guarantee that some customers will be deeply disappointed.

Best personal budgeting software 2018 pro#

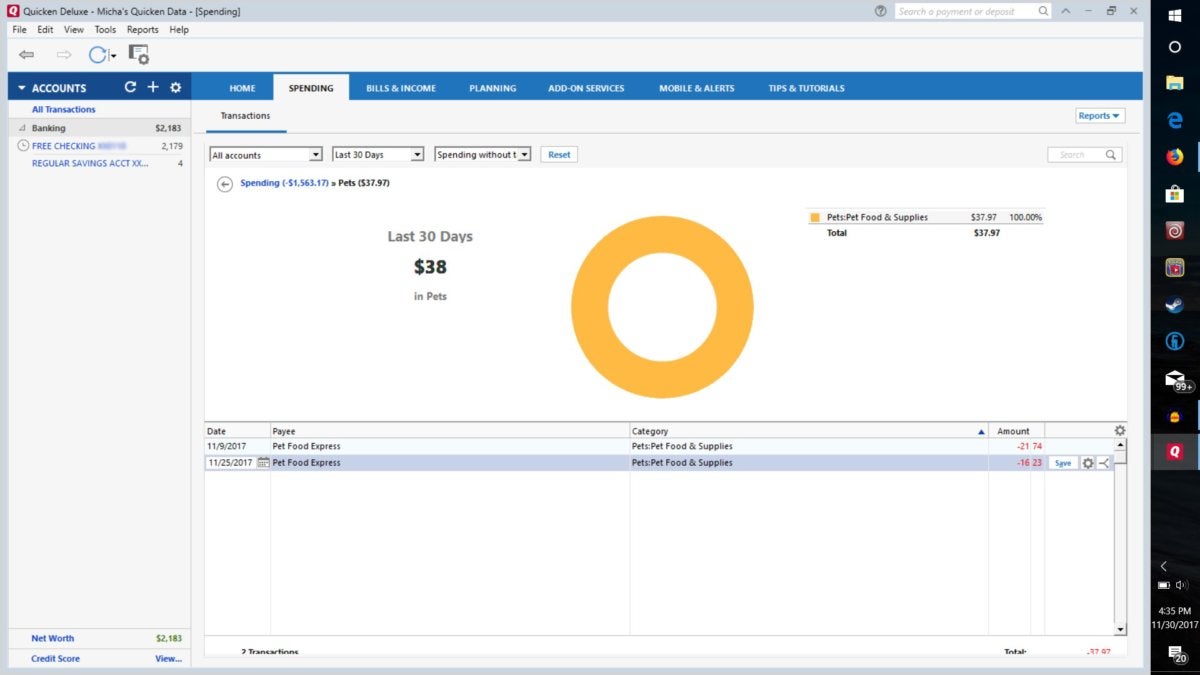

Quicken Starter 2018: a pro solution at a great price.

Best personal budgeting software 2018 for mac#

The best financial software for Mac will help you track transactions, connect to your bank accounts, and manage your budget. Accounting Software For Mac 2018 Budgeting Software For Mac 2018 Holiday The software starts at $34.99 and is available for Windows, MacOS, iOS, and Android. The app is robust enough to manage both your personal and business expenses and even handles property management functions like rental payments from tenants. You can even use it to track the value of your assets to have an accurate calculation of your total net worth. Some of the more advanced features include bill paying, which allows you to set up payments for your bills right from the software. The software features Excel exporting, which allows you to manipulate and perform additional calculations on your data. You can use the software to manage various aspects of your financial life from budget creation to debt tracking, savings goals, and even investment coaching. Having been around for several decades, Quicken is one of the most established of all the personal finance software on the market.

0 kommentar(er)

0 kommentar(er)